ETFs have seen a surge in popularity in recent years, and this is reflected in the growth of assets under management (AUM). Due to their flexible nature, more people are turning to them at the expense of mutual funds.

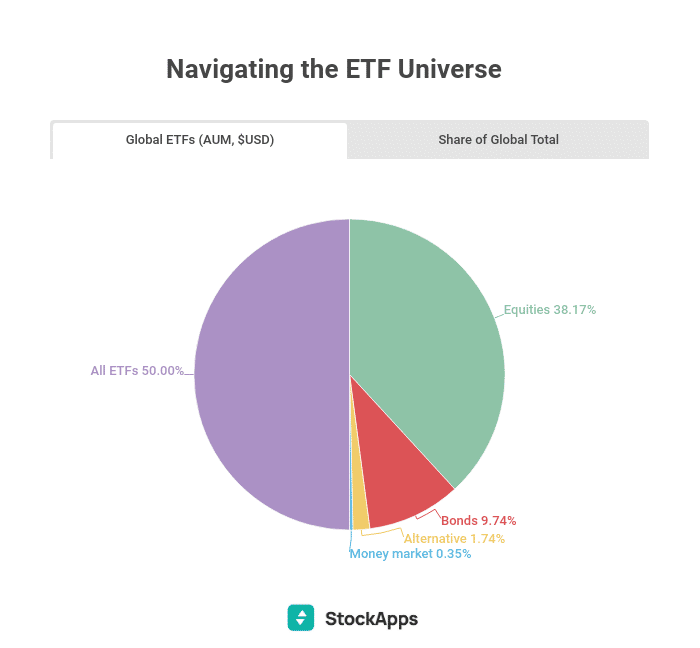

The year 2022 has seen tremendous growth. According to data from StockApps.com, ETF’s assets under management grew past the $5T mark in 2022

By June 2021, the U.S. ETF business had grown to $3.9 trillion, thanks mainly to the SEC regulation established in 2019. This figure was up from $2.6 trillion before the pandemic. Currently, in the year 2022, the market is worth more than $5 trillion. This trend is favorable for ETF shareholders looking to increase their holdings.

Speaking on the data, the CEO of StockApps.com, Edith Reads, said. “ETF is a low-risk investment, according to most investors. Apart from being affordable, they hold several equities and securities, giving them diversification. Besides, ETFs focusing on crypto made it so appealing to digital asset investors. Thus, it is generic that ETF’s AUM rose past the $5 trillion mark this year.”

Why are ETFs booming?

ETFs have exploded since the 1990s. By 2020, nearly 7,600 ETFs encompass all major asset classes, sizes, and styles. If you are an investor, there is undoubtedly an ETF that covers it.

Unlike many traditional mutual funds, ETFs do not make taxable year-end distributions. The reason is that most ETFs follow an index and have lower turnover. One only owes taxes on the gains and losses from the individual transactions in an ETF.

Compared to traditional mutual funds, the liquidity of ETFs is a significant selling point for these investments. Because ETFs are traded on an exchange, investors have 24-hour access to their funds and can make several trades during a single trading day.

One can only buy or sell shares of a classic mutual fund once daily, at market close. To put it bluntly, if you own a typical mutual fund and the market suddenly shifts, you could lose money if you can not quickly enter or exit your position.

Should you invest in ETFs for the short term or the long term?

Depending on the length of your investment horizon, ETFs can act as either long-term or short-term investments. And there are hundreds of ETF options available for investments.

For instance, if you want a long-term investment, you might use an ETF focusing on blue-chip firms. If your interest is in making a short-term investment to achieve rapid development, go for an ETF, which invests in new businesses.

Leave a Comment